Mortgage rates: are at an all-time low, which is great news for homebuyers. However, it's important to understand how these rates are determined before you start shopping for a home. In this blog post, we'll explore how mortgage rates are set and what factors can influence them. We'll also provide some tips on how you can get the best mortgage rate possible. So if you're thinking of buying a home, read on to learn more about mortgage rates!

|

| Mortgage rates |

Current mortgage rates

Current mortgage rates are at an all-time low! It's a terrific moment to buy a house or refinance your existing one if you've been considering doing so.Rates are expected to begin rising again in the next few years, so lock in a low rate now while you can.

👉👉👉Click here:https://brilliantcompany.blogspot.com/2022/10/blog-post_663.html

There are a few things to consider when shopping for a mortgage:

-Your credit score: Your interest rate will be lower the higher your credit score. If you have any blemishes on your credit report, now is the time to work on fixing them.

-The type of loan you want: There are many different types of loans available, each with its own set of pros and cons. Talk to a lender to find out which loan is right for you.

-Your down payment: The larger your down payment, the lower your monthly payments will be. However, you may be able to qualify for special programs that allow you to buy a home with little or no money down.

Get started today by talking to a lender and finding out what mortgage options are available to you.

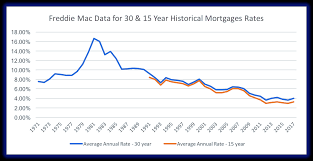

30-year mortgage rates

30-year mortgage rates are at an all-time low!It's a terrific moment to buy a house or refinance your existing one if you've been considering doing so. Rates are expected to stay low for the foreseeable future, so lock in a great rate while you can.

👉👉👉Click here:https://ecommcompany.blogspot.com/

15-year mortgage rates

If you're looking to take out a 15-year mortgage, you can expect to pay a higher interest rate than you would on a 30-year mortgage. 15-year mortgage rates are typically about 0.5% to 1% lower than 30-year mortgage rates, but your monthly payments will be much higher because you're paying off the loan in half the time.

When considering a 15-year mortgage, it's important to weigh the pros and cons carefully. On the plus side, you'll save a lot of money in interest over the life of the loan. On the downside, your monthly payments will be much higher and if you run into financial trouble, it will be harder to get out of debt since you'll have less time to make up for missed payments.

If you're sure you can handle the higher monthly payments and want to save money on interest over the long run, a 15-year mortgage may be right for you. Just be sure to shop around and compare rates from multiple lenders before making a decision.

5/1 ARM mortgage rates

As of July 2019, the average interest rate for a 5/1 ARM mortgage is 3.77% with an APR of 4.10%. Mortgage rates for 5/1 ARMs are often lower than traditional 30-year fixed-rate mortgages because they offer a lower monthly payment for a set period of time. After the initial five years, your monthly payments will adjust annually based on the current market rate.

If you're considering a 5/1 ARM mortgage, it's important to weigh the pros and cons before committing to this type of home loan. On the plus side, a 5/1 ARM can be a great way to save money on your monthly mortgage payments. However, there is some risk involved with this type of loan, as your interest rate could increase after the five-year fixed-rate period ends.

Before deciding if a 5/1 ARM is right for you, make sure to speak with a qualified mortgage lender about all of your options.

👉👉👉Visit now:https://eagleecompany.blogspot.com/

Factors that affect mortgage rates

There are many factors that affect mortgage ratesWhile some of these variables are under your control, others are not,

The most important factor that affects mortgage rates is the health of the economy. When the economy is doing well, mortgage rates tend to be low. Conversely, when the economy is struggling, mortgage rates tend to be high. This is because lenders want to protect themselves from borrowers who may default on their loans during tough economic times.

Another factor that can affect mortgage rates is inflation. Inflation can cause mortgage rates to rise, as lenders need to charge more interest to make up for the loss in purchasing power of their money.

Finally, the Federal Reserve can also influence mortgage rates. The Fed controls interest rates by setting the federal funds rate, which impacts short-term borrowing costs. When the Fed raises interest rates, it usually results in higher mortgage rates as well.

How to get the best mortgage rate

There are a few things you can do to ensure you get the best mortgage rate possible. First, shop around and compare rates from multiple lenders. Secondly, make sure your credit score is as high as it can be. The higher your credit score, the lower your interest rate will be. Finally, consider making a larger down payment. A larger down payment will lower your loan-to-value ratio and may help you qualify for a better interest rate.

Conclusion

Mortgage rates are at an all-time low, which makes now a great time to buy a home. If you're considering buying a home, be sure to shop around for the best mortgage rate and get pre-approved for a loan before making an offer on a house. With interest rates expected to rise in the coming years, now is the time to take advantage of historically low mortgage rates.

👉👉👉Click here:https://petleash.blogspot.com/

0 Comments